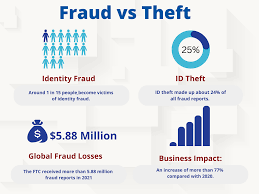

Identity theft and fraud in the United States present a complex and ever-evolving challenge, impacting millions of individuals and the economy at large. With the digital age advancing rapidly, personal information has become more accessible, providing a fertile ground for fraudsters to exploit vulnerabilities. This detailed analysis delves into the mechanisms of these crimes, their impacts on individuals and society, and the multifaceted approach required to combat them.

The Mechanisms Behind Identity Theft and Fraud

Identity theft involves acquiring someone’s personal information without their consent, typically to commit fraud or theft. This can include names, Social Security numbers, bank account details, and more. The methods employed by identity thieves are diverse, ranging from high-tech hacking to low-tech dumpster diving.

Phishing is a common technique where fraudsters trick victims into revealing personal information through deceptive emails or websites. Skimming involves stealing credit card information using devices placed on ATMs or point-of-sale systems. Data breaches are another significant source of personal information for criminals, involving unauthorized access to corporate or governmental databases.

The Impact on Individuals

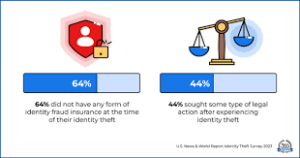

The immediate consequence of identity theft can be financial loss, but the repercussions extend far beyond unauthorized charges. Victims often spend months, if not years, restoring their financial health and credit scores. The psychological impact is also profound, with victims reporting feelings of violation, stress, and anxiety.

The broader societal impacts are equally concerning. Identity theft and fraud erode trust in financial institutions and digital commerce, potentially hampering economic growth. Businesses, too, bear the cost, investing heavily in cybersecurity measures and dealing with the fallout from data breaches.

Combating Identity Theft and Fraud

The fight against these crimes is multifaceted, involving legal, technological, and educational efforts.

Legal Frameworks

The United States has developed a robust legal framework to address identity theft and fraud. The Identity Theft and Assumption Deterrence Act, enacted in 1998, makes identity theft a federal crime. The Fair and Accurate Credit Transactions Act (FACTA) of 2003 provides consumers with tools to protect themselves, including the right to free credit reports and the ability to place fraud alerts on their credit histories.

Despite these laws, challenges remain in prosecution and prevention. Identity theft often crosses state and even international borders, complicating legal actions. Moreover, the rapid pace of technological change can outstrip existing regulations, requiring constant vigilance and adaptation from lawmakers.

Technological Innovations

On the technological front, advances in encryption, authentication, and fraud detection are critical. Financial institutions and online retailers employ sophisticated algorithms to detect unusual transactions that could indicate fraud. Two-factor authentication and biometric verification are becoming more common, providing additional security layers for consumers.

However, as security measures become more advanced, so too do the tactics of fraudsters. It’s a continuous arms race, with each side constantly evolving to outmaneuver the other.

Consumer Education

Perhaps the most critical component in combating identity theft and fraud is consumer education. Awareness of the risks and knowledge of protective measures can significantly reduce the likelihood of becoming a victim.

Individuals are advised to monitor their credit reports regularly, use strong, unique passwords for online accounts, and be skeptical of unsolicited requests for personal information. During tax season, filing early can preempt tax fraud, a common tactic where criminals submit fraudulent tax returns to steal refunds

Emerging Trends in Identity Theft and Fraud

As technology evolves, so do the tactics of identity thieves and fraudsters. Synthetic identity fraud is a growing trend, where criminals combine real and fabricated information to create new identities. These synthetic identities can be used to open fraudulent accounts, potentially going undetected for years.

Social media has also become a fertile ground for identity theft. Fraudsters mine personal information shared publicly to piece together profiles that can be exploited in scams or used to answer security questions that protect sensitive accounts.

The Role of Artificial Intelligence in Combatting Fraud

Artificial Intelligence (AI) and Machine Learning (ML) are on the frontline in the battle against identity theft and fraud. Financial institutions use these technologies to analyze transaction patterns in real-time, identifying anomalies that could indicate fraud. This proactive approach can freeze suspicious transactions before they are completed, significantly mitigating potential damage.

AI-driven identity verification systems are becoming more sophisticated, utilizing biometrics (like facial recognition, fingerprints, and voice patterns) to ensure that the person accessing an account or conducting a transaction is the legitimate owner of that identity.

The Impact of Legislation and Policy

In recent years, there has been a push for more stringent regulations around data privacy and protection. The General Data Protection Regulation (GDPR) in Europe has set a precedent that many in the USA are calling to emulate. Legislation like the California Consumer Privacy Act (CCPA) represents steps toward more robust data privacy laws at the state level, aiming to give consumers greater control over their personal information.

Such legislation not only aims to protect personal information but also imposes significant penalties for corporations that fail to safeguard data adequately, incentivizing better security practices.

Community and Individual-Level Solutions

On a community level, education and awareness programs are critical. Local governments, nonprofits, and educational institutions can play a vital role in disseminating information about protecting personal information and recognizing fraud attempts.

For individuals, beyond the commonly advised precautions, it’s essential to adopt a mindset of vigilance. This includes being cautious about oversharing on social media, understanding the value of personal information to fraudsters, and recognizing that identity theft can happen to anyone. Tools like credit freezes, which prevent new accounts from being opened in one’s name, and services that monitor the dark web for personal information, offer additional layers of protection.

Conclusion

Identity theft and fraud in the USA constitute a significant threat to individuals and the economy, necessitating a comprehensive and adaptive approach to mitigation. While legal and technological measures form the backbone of this effort, consumer education and awareness remain crucial. As technology advances, the strategies employed by both criminals and those fighting against them will continue to evolve. The ongoing challenge will be to stay one step ahead, ensuring that the digital age remains an era of opportunity, not vulnerability.

This concise analysis, while not exhaustive, underscores the complex nature of identity theft and fraud, highlighting the multifaceted strategies required to combat these pervasive issues. The continuous collaboration between government bodies, private sector entities, and individuals is essential in safeguarding personal and financial information in an increasingly digital world.